Aadhaar PAN Link 2022 (Last Date): You have only two days left to link PAN (Permanent Account Number) with an Aadhar card. The last date for linking PAN with Aadhaar has been fixed by the Income Tax Department as of March 31, 2022.

The Income Tax Department also says that it takes a minute to link PAN with Aadhaar, so what is the need to delay in linking it? The sooner you link it, the less your loss will be. Let us know that if PAN is not linked with Aadhaar, then what are the disadvantages of it.

10 Thousand Rupees Will Be Fined:

According to media reports, if you do not link PAN and Aadhaar by March 31, 2022, then you may have to pay a fine of Rs 10,000. If you have linked PAN and Aadhaar even after March 31, then first you will have to pay a fine of 10 thousand rupees.

Government Schemes Will Not Get The Benefit:

As you know Aadhaar number has now become a government document. Although the purpose of the government behind making the Aadhaar of the people of the country was to issue a national identification number, later it was used as a government document.

Now if your Aadhaar is not linked with PAN, then you will not be able to get the benefit of any government scheme. For example, your ration card will not be able to be made, you will not be able to open an account in banks and post offices, you will not be able to do financial transactions and there will be obstacles in any government or private work.

Link Between Aadhaar Card With Pan Card 2022:

How to link Aadhaar Card and Pan Card -step by step process in detail check below;

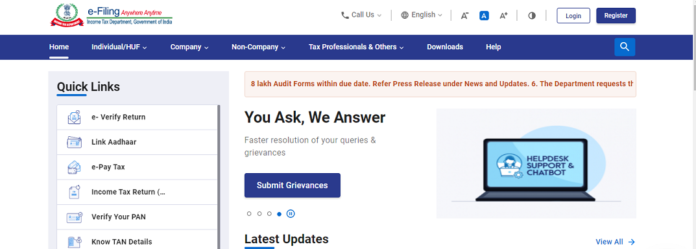

Firstly, you have to click on this link https://www.incometaxindiaefiling.gov.in/home.

After that, click on Link Aadhaar.

Then, you have to fill in your details and your PAN card will be linked with an Aadhar card.

At last, to use the SMS service, Aadhaar can be linked with a PAN card by sending a message to 567678 or 56161.

Aadhaar And PAN Card Linked Status Check 2022:

How to check Aadhaar and Pan Card linked status 2022 -in detail below;

First of all, go to the official website of Income Tax, incometax.gov.

hen, you will see the option of ‘Link Base Status’, click on it.

After that, the next page will open where you have to enter your Aadhaar and PAN number and click on link status.

At last, On clicking, it will be shown on the screen whether Aadhar-PAN is linked or not.

Read More: Study of Different Branch| General Knowledge| According to the Alphabetic Order| Part – II