Income Tax Rules 2023 (NEW): Digital transactions have become more prevalent in India now. However, citizens still rely on traditional methods of keeping money at home. In such a situation, you should know how much cash a person can keep at home. Note that this also has its limits.

Although the Income Tax Act does not put any limit on the amount of money that can be deposited in the house, the person has to furnish the source of the money if the Income Tax authorities conduct a raid. And, if the documents do not match the amount kept in the house, the Income Tax officials can penalize the person.

Unaccounted money can be confiscated by Income Tax officials in certain situations and a penalty of up to 137 percent of the total amount can be imposed.

Cash limit at home (Income Tax Rules):

The Income Tax Department has not specified any limit for keeping cash at home, but it should be according to your income or its source. If you have earned or received that money properly and for that you have complete documents or have filled income tax return then there is no worry. On investigation, it is necessary to tell the source of that cash.

Cash transactions above Rs 2 lakh

Under the Income Tax Act, there are rules regarding cash transactions above Rs 2 lakh. Section 269ST of the Income Tax Act prohibits any person from accepting cash in excess of Rs 2 lakh from one person and on a single day.

At the same time, this section prohibits in respect of multiple transactions received from one person relating to the same event or occasion. Instead, it has to be paid through cheque, card payment or bank transfer.

How to avoid fines?

To avoid such penalties and keep yourself and your family safe, it is important to remember the cash handling rules framed by the Income Tax Department. For example, no person is allowed to accept a cash amounts of Rs 20,000 or more for any loan or deposit. This rule also applies to the transfer of immovable property of a person. Cash transactions exceeding Rs 20 lakh in any financial year can attract a penalty only if they are unaccounted for and unsourced.

Additionally, the Central Board of Direct Taxation mandates that PAN numbers and related information be furnished for deposits or withdrawals exceeding Rs 50,000 at a time. An account holder will have to provide his PAN and Aadhaar details if he deposits Rs 20 lakh in cash in a year.

In the case of a gift (Income Tax Rules):

When it comes to giving or receiving gifts, no person can accept a cash gift of more than Rs 2 lakh from anyone on one occasion. This rule also applies to the money received by a person from his relative. Those who break this rule and accept cash in excess of Rs 2 lakh can be fined equally to the same amount.

For business

For business, a person cannot make a cash payment of more than Rs 10,000 as an expense in a single day. However, for transporters, this limit is Rs 35,000.

Read More: BSNL Recruitment 2023 | Apply Link (Graduate/Diploma in Engg.)

In case of loan payment

In case of loan payment, a person cannot accept an amount exceeding Rs.20,000 in cash or make payment/repayment to any entity or individual under section 269SS and 269T of the Income Tax Act.

This rule also applies to loan repayment. Even for cash transactions including advances in property transactions, there is an upper limit of Rs 20,000. In violation, the Income Tax Department can recover 100 percent of the loan or deposit amount as penalty.

For cash transactions above Rs 20 lakh

A cash transaction of more than Rs 20 lakh in a financial year can also attract a penalty, if you have not disclosed its source. If you make a cash deposit of more than Rs 20 lakh in your bank account in a year, even then you will have to show PAN and Aadhaar in the bank.

You will have to show your PAN card for withdrawal or deposit of more than Rs 50,000 in the bank in one go. While shopping, payment of more than 2 lahks cannot be made in cash. For this also have to show PAN and Aadhaar.

Medical insurance premium (Income Tax Rules):

The government has also prescribed that taxpayers should adhere to the limit while paying their medical insurance premiums. All medical premiums are to be paid by any means other than cash, failing which the taxpayer becomes ineligible to claim a deduction under section 80D.

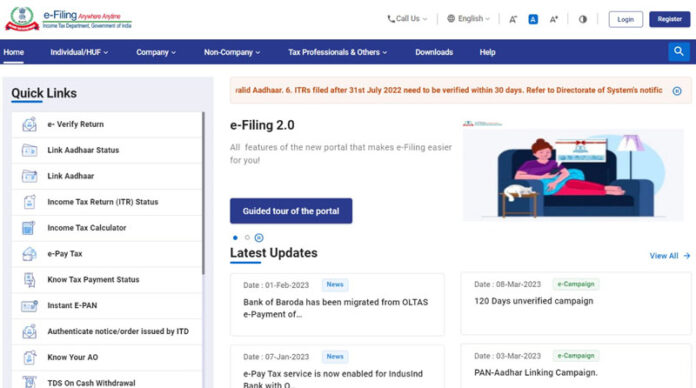

Income Tax Department Official Website: Link